By Trevor Sprague, Senior Project Director

Does this hiring story sound familiar? You throw some job postings online, go through a standard set of interview questions, and then pick whoever seems to fit. If you only had one applicant, there’s a good chance you hired them. If there were only a couple, you chose the lesser of the two evils. If this sounds even remotely familiar, it’s time to refresh the way you look at your hiring practices.

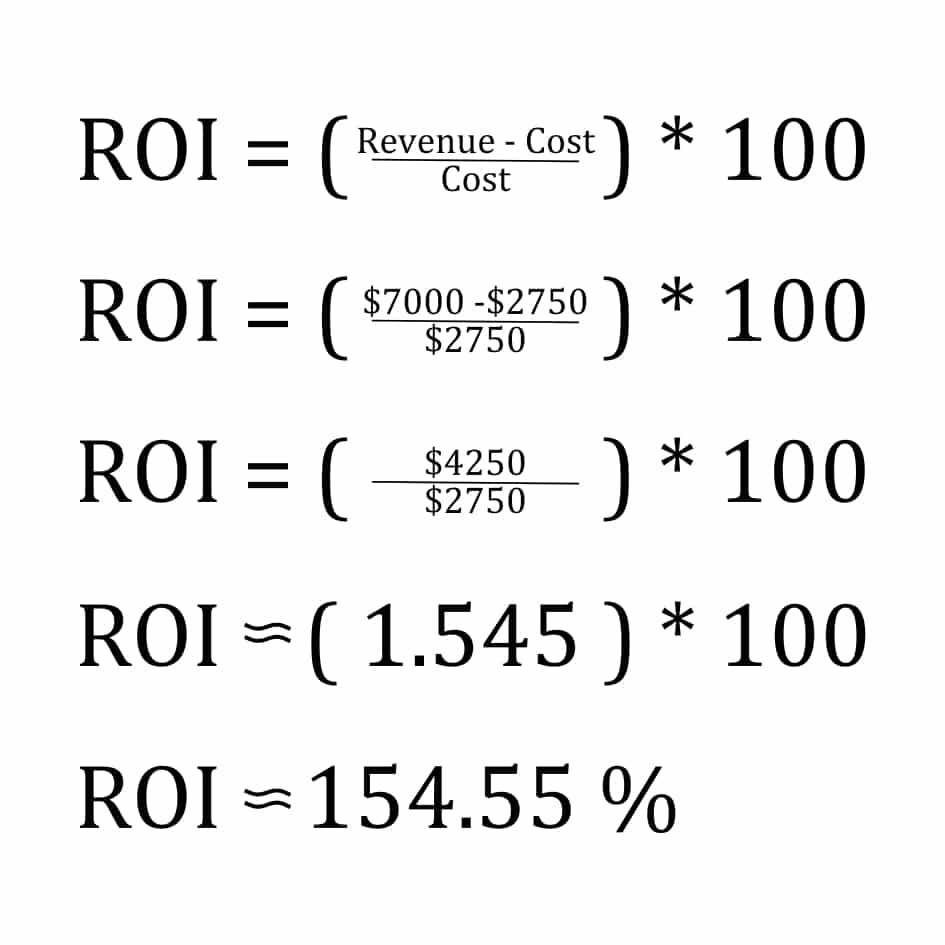

Best hiring practices boil down to intentionality, transparency, and data. Incorporating these three ingredients into your hiring process and practices will get you closer to the outcomes you are looking for when finding the next member of your team.

Identify Your Data Sources and Costs

The first question you must answer is, “What data do I have available about my hiring practices?” Are you tracking where your applicants come from? Even more importantly, are you tracking where the most qualified applicants come from? How much are you spending on the sources that get you great results as compared to the sources that return poor outcomes? These are just some of the questions you should be asking yourself.

Consider the costs of hiring someone you will need to train over the next year (or longer) versus hiring someone highly qualified. Hiring someone at a low salary can seem appealing and economical and is often how small businesses operate. Don’t fall into this trap.

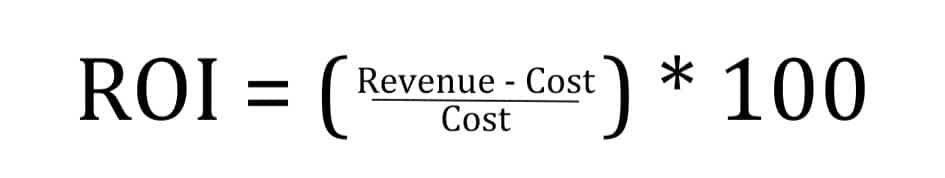

Challenge yourself to consider hiring someone highly qualified for your leadership roles. While it may seem more costly up front, over time the amount you will need to invest in someone to get them to a highly qualified level will end up being significantly higher than hiring that person from the start. Someone highly qualified will bring best practices and contribute to improved margins right off the bat. Considering this, the math will tell you that the highly qualified candidate is the better bargain. To understand the math for your business, consider your cost per hire, employee retention rate, and time spent from posting to filling the position.

The Need for Speed and Measurement

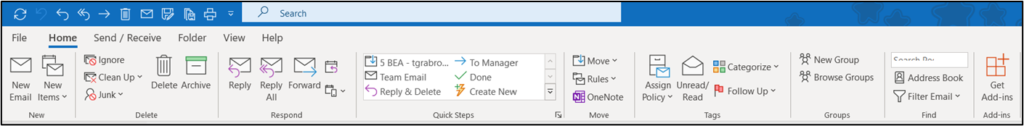

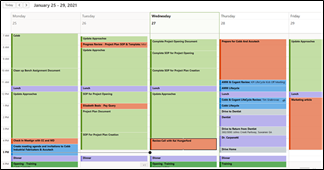

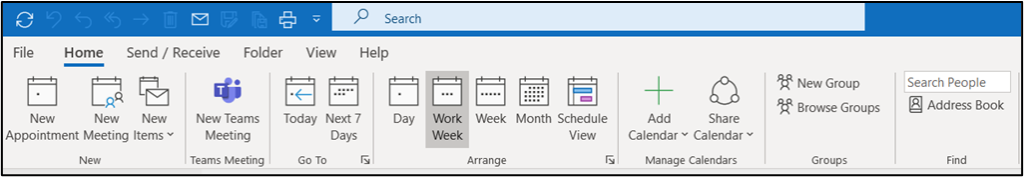

Hiring qualified candidates takes intentionality and speed, especially in today’s job market. How quickly are you responding to applications? How soon are you holding an interview after receiving the application? How soon after receiving an application are you sending a job offer? Are you responding to everyone? How are you selecting which candidates to interview? In this job market, measurements get results. There are options for Applicant Tracking Software if you’re in continuous recruitment mode. You can also build your own using a spreadsheet.

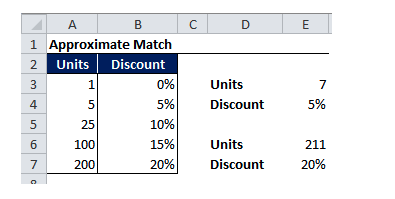

Speaking of measurements, how you select which candidates to interview can also be based on measurement. Consider creating a candidate qualification matrix that lists the skills, experience, and qualities required for the position. Weigh those skills, experiences, and qualities based on what’s most important for the role. Then, score your applicants against the matrix. For example, 50% for skills, 30% for cultural fit, and 20% for experience. Set a threshold that clearly determines who is worth your time to interview and who to politely respond to with, “Thank you for your application.”

Utilize Intentional Questions and AI

Once you have the right people to interview, what are you asking them? Too often, employers ask questions for the sake of asking questions. These are questions you were probably asked in an interview at one point, and they seem like questions that everyone gets asked at an interview.

Consider taking a well-thought-out job description with key performance indicators and feeding the document into AI. Then, ask AI to determine what interview questions you should ask, along with the rationale for each question and what you should be looking for in the response. Even if you don’t use AI, every question should have a rationale. What is it you are trying to learn about your candidate? Ask questions that will provide those answers.

I would be remiss if I didn’t issue a warning about the use of AI. While AI is a great resource, at the end of the day, it is our responsibility to ensure that what we glean from AI is accurate and does not provide questions that violate anti-discrimination laws.

Wait for the Right Fit and Be Transparent

I once had a position open for six months. This was not due to lack of applicants or interviews, but because each time I conducted an interview, I hadn’t found what I needed for the business. I will admit that this put pressure on other people in the organization, which in turn put pressure on me to fill the role. Still, I resisted putting a body into a role so I could mark it complete. However, once I found the right person for the job, other employees were thrilled with the level of contribution this leader brought to the table. Not only did those other employees no longer have that extra pressure, but they were able to function even better in their roles than with the prior holder of that position.

Finally, be transparent throughout the hiring process. When interviewing candidates, or even when posting the position online, be clear about your requirements. Make sure the job description and key performance indicators are clear. If we are holding back because we are worried about someone not taking the job due to compensation, responsibilities, or performance expectations, you are setting yourself up for future conflict, potential loss of the employee and the investment you made to find them, and restarting the hiring process for this position from the beginning all over again.

Implement intentionality, transparency, and data in your hiring practices, and prepare to be wowed by the results.