From Struggling to Scaling

By Samantha Turba, Assistant Director of Marketer

Learn how one industrial plating company turned a monthly $500K loss into $1M in growth.

When a manufacturing business lost its biggest customer overnight, there wasn’t a plan – just an outdated website and no digital marketing strategy.

In under a year, the Cogent Analytics marketing team helped this manufacturing company:

Boost their revenue by $1 million and net income by over $150K

Rebuild and restructure their website for conversions

Launch targeted Google Ads that brought in 244 qualified leads

Cut their cost-per-lead to under $45

Expand their brand visibility through strategic blogs, video, email, and social media marketing

Today, they rank on Google for core services, appear in industry searches, and are so busy they’ve scaled back ad spend for the first time just so they can keep up with demand.

This isn’t a one-time campaign. It’s the power of a smart, strategic marketing foundation.

1. Business Profile

Industry: Manufacturing

Sub-Industry: Industrial Metal Plating

Location: Texas – serving nationally

Starting Revenue (2023): $1,234,658

Ending Revenue (YTD July 2025): $2,234,658

Starting Net Income (2023): $168,252.93

Ending Net Income (YTD July 2025): $318,252.93

This industrial plating company provides precision coating solutions for various metal components, servicing a variety of high-spec industries like oil and gas, aerospace, electronics, and military manufacturing. They have operated for years with a strong emphasis on craftsmanship and quality, but relied exclusively on word-of-mouth for client acquisition. Despite having a reputable name among legacy contacts, their lack of digital marketing made them invisible online to potential clients.

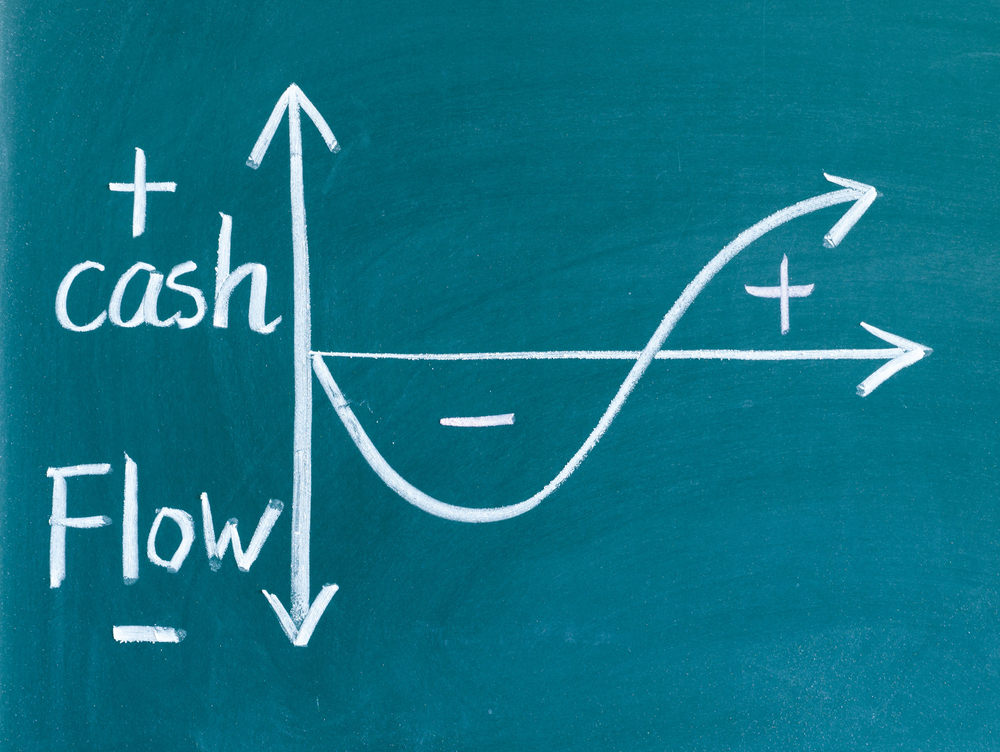

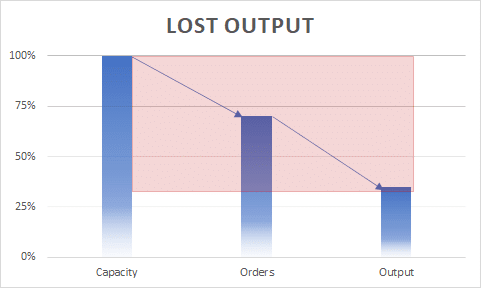

By mid-2024, their operations faced serious challenges. A longtime customer worth $500,000 per month unexpectedly exited their partnership, exposing the vulnerability of a referral-only strategy. Without online visibility or lead generation channels in place, the company lacked a means to stabilize its cash flow or quickly replace the lost revenue. Their revenue was plummeting, and they needed fast, strategic marketing support not only to survive, but to rebuild.

What followed was a complete digital transformation through strategic Search Engine Optimized (SEO) content, digital advertising, and brand positioning. In less than a year, the client’s gross income increased by over $1 million, gross profit rose by more than $200k, and net income jumped by over $150k, all a direct result of intentional and strategic marketing efforts.

2. Initial Challenges

This company found itself in an immediate cash flow crisis. Their regular $500K/month client loss left a revenue void that could not be filled through traditional means. The company’s website was outdated, unoptimized, and offered no service-specific phrasing or keywords to attract new business. There were no ads running, no SEO strategies implemented, and no inbound funnel for capturing new leads.

Without a digital footprint, the client was invisible on Google, and in today’s industrial buying cycle, search visibility is a critical first touchpoint – especially on a search engine like Google where clients are actively searching for businesses. The client had no social presence, no email marketing to stay in front of contacts, and no way to target specific industries or keywords. The company needed more than just leads; it required a full marketing infrastructure overhaul.

3. Strategic Marketing Solutions

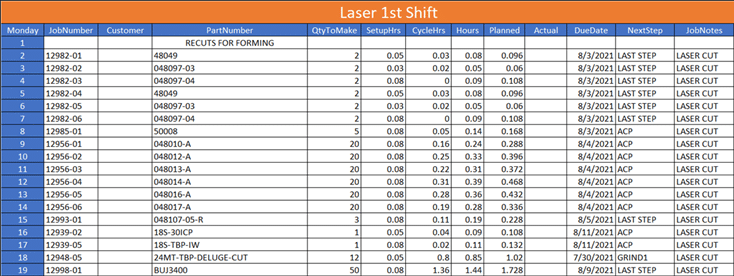

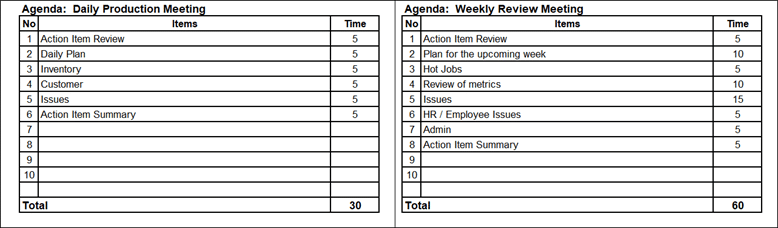

- Emergency Lead Generation via PPC and Landing Page: In August 2024, the Cogent Analytics marketing team launched a rapid-response initiative to generate leads immediately. A specialized landing page built to highlight their copper and electroless nickel plating services was designed for high conversion, with technical specs, industrial applications, and strong calls-to-action. A tightly targeted Google Ads campaign was launched to direct search traffic to this page, focusing on buyers in oil and gas, machining, and OEM spaces. The initial ad spend was limited to a modest $1,000/month but optimized for high-intent keywords.

- Website Rebuild and Content Overhaul: While ads ran to generate short-term leads, we simultaneously worked on a complete website rebuild. The new site launched in November 2024, three months into our marketing engagement with the client. We strategically rewrote every major page to include technical details, industry applications, and SEO-focused structure. We added new service pages for Clear Plating and Consulting, and refreshed the Home and Services pages for clarity and keyword ranking. Technical SEO was also integrated along with internal linking and proper conversion flow throughout the site for an optimized user experience.

- Full Service Marketing Effort Transition: By mid-November 2024, our marketing efforts shifted to focus on highlighting the client’s new website along with a number of other critical initiatives. These included:

- Expanding Google Ads campaigns to all services, with new ad groups targeting plated finish types and niche industries

- Social content strategy on LinkedIn and Facebook, geared toward industry credibility and brand recognition

- Monthly blog content to maintain SEO freshness and topical authority

- Monthly email campaigns sent to clients and leads

- YouTube video content creation, deployed both organically and through Google Performance Max campaigns

This updated strategy was designed to build on their current lead generation efforts and also contribute to their long-term brand equity. Ads now support conversions, while organic presence has improved over time. Every marketing channel pointed back to the company’s core service differentiators.

4. Operational Results

- Google Ads Performance (August 2024 – July 2025): Over the course of 12 months, Google Ads generated a total of 244 qualified leads, including 155 tracked phone calls over 60 seconds in length and 89 quote form submissions from just $9,070 in spend – an average cost per conversion of $37.17. Click-through-rates (CTRs) on key campaigns outperformed industry benchmarks: Silver Plating reached 10.75%, Gold Plating hit 9.45%, and Copper Plating drew 6.81%.

- Lead Quality and Volume: This manufacturing company transitioned from having no inbound leads to a reliable, scalable pipeline. Ad performance improved with the development of better landing pages and website content. Once service pages were live on the website, campaign costs dropped as Google rewarded higher Quality Scores associated with our organic efforts. Eventually, the lead flow became so strong and the client was so busy with the amount of inbound leads that they scaled back advertising to focus on fulfillment.

- Content and Organic Visibility: With monthly blogs, videos, and updated service pages, the client began to rank for industrial plating keywords. YouTube content boosted visibility in brand campaigns. Email newsletters helped re-engage dormant accounts. LinkedIn and Facebook created credibility with prospective clients.

- Strategic Shift: One year after starting an engagement with Cogent Analytics’ marketing team, the business was no longer in crisis. The company shifted from being desperate for new work to filtering leads for high-fit projects. Operations were full. Growth was back on track and driven by their own brand visibility, not external referrals.

5. ROI & Financial Impact

Marketing Spend:

$15,000 for initial project work (landing page, website, PPC setup)

$24,000 in ongoing managed services ($3,000/month for 8 months)

$9,070 in Google Ads for 9 months

Total Investment: $48,070

Revenue Impact:

2023 Revenue: $1,234,658

YTD July 2025 Revenue: $2,234,658

Revenue Growth: $1,000,000

Net Income Impact:

2023 Net Income: $168,252.93

YTD July 2025 Net Income: $318,252.93

Net Income Growth: $150,000

Return on Investment:

Net Income ROI: 3.57x

Revenue ROI: 24x

6. Conclusion

This industrial plating company is solid proof that marketing is not a luxury or something that only serves aesthetic purposes, but rather a growth lever. When referrals dried up and a major customer walked, this client didn’t wait for luck. They took action and built a modern digital foundation from the ground up with marketers who care about real conversions and ROI.

Through smart strategy, paid media, content creation, and targeted SEO, they not only replaced their lost revenue but surpassed it. Their brand is now recognized across their niche, their website converts, their ads perform, and their team is no longer wondering when and where the next lead will come from.

Client Testimonial

“We have had an influx of work coming through and actually need to pause ads just to catch up on leads! This time last year, we never could have imagined such a positive outcome from marketing. It saved our business.”

This wasn’t just marketing. It was a transformation.